AHCA/NCAL Insurance Solutions offers a minimum essential coverage (MEC) health plan to members. The

plan was developed by Compass Total Benefit Solutions and offers two affordable options for providing many of the health insurance benefits that are important to long term care employees. This

short video explains the MEC plan for AHCA/NCAL members and highlights the features that make the MEC plan so popular with LTC employers and employees.

Both

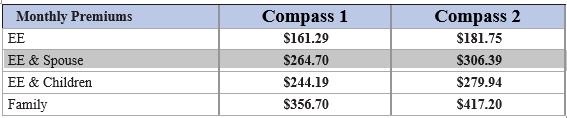

Compass plans feature affordable premiums and co-pays for valued and commonly used services, including prescriptions, physician visits and free unlimited 24/7 access to TELADOC®. Benefits are first dollar payments and there are no deductibles or pre-existing condition limitations. The difference in the two plans is based on the level of hospital indemnity benefits. Here’s the exclusive AHCA/NCAL “Member Only” rate schedule:

![]()

The plan is designed to help AHCA/NCAL members recruit and retain frontline staff who cannot afford major medical health plan premiums or high deductibles. Employers determine their level of contribution for plan expenses for coverage for employees, their spouses, their children or family coverage.

There is no additional underwriting for the Compass plan and no mandatory wait periods for new employees to join the Compass MEC plans. Any wait periods are determined by the employer. There is a minimum of 10 employees that must be enrolled to offer the plan.

This

2021 Enrollment Guide for AHCA/NCAL members has more information about the plan. The plan is available in all 50 states. Some states have different hospital indemnity benefits based on specific state rules and approvals.